California has initiated an EITC beginning 2015. California and twenty-five other states plus the District of Columbia now offer an EITC. In twenty-two of these states, including California, the credit is refundable. Most states set their EITC as a portion of the federal EITC, and most states conform to the federal EITC program in other aspects such as eligibility requirements and income levels.

California has initiated an EITC beginning 2015. California and twenty-five other states plus the District of Columbia now offer an EITC. In twenty-two of these states, including California, the credit is refundable. Most states set their EITC as a portion of the federal EITC, and most states conform to the federal EITC program in other aspects such as eligibility requirements and income levels.  The California EITC will generally follow the eligibility requirements of the federal EITC, but will be limited to verifiable earned income that is subject to California wage withholding. Additionally, the earned income limitations for the California EITC (the amount where the CA EITC will be fully phased-out) will be lower than those for the federal EITC.

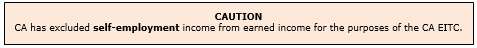

The California EITC will generally follow the eligibility requirements of the federal EITC, but will be limited to verifiable earned income that is subject to California wage withholding. Additionally, the earned income limitations for the California EITC (the amount where the CA EITC will be fully phased-out) will be lower than those for the federal EITC.

COMPARISONS

Credit Rates – The CA credit rates are the same as the federal: 7.65% without a qualifying child, 34% with one qualifying child, 40% with 2 qualifying children and 45% with three or more.

Earned Income – The earned income amount to which the credit rates apply for CA is 50% of the federal amounts, thus resulting in a lower credit amount for CA. The following are comparisons between Federal and CA:

Phase Out – CA phases out the credit at a rate substantially different than the Federal. Once the CA EITC reaches the maximum, it immediately begins to phase out at the same rate, while the Federal EITC continues at the maximum for a bit and then phases at a rate slower than the credit rate. See illustration below:

The phase-out amounts for federal are higher for taxpayers filing married joint, but for California the phase-out amounts are the same for all filing statuses (neither federal nor California allows the EITC if filing married separate status).

California Earned Income - For California EITC purposes, "earned income" only includes amounts that are subject to California withholding, including:

- W-2 wages,

- Salaries,

- Tips, and

- Other employee compensation